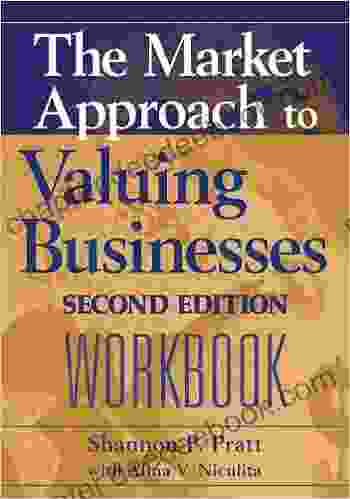

The Market Approach to Valuing Businesses: A Comprehensive Guide

Overview

Business valuation is a crucial aspect of financial planning, investment decision-making, and strategic planning. Among the three primary valuation approaches, the market approach stands out as a widely-accepted methodology for valuing businesses based on comparable market data.

This article provides a comprehensive guide to the market approach, leveraging the invaluable insights from the Market Approach to Valuing Businesses Workbook. We will explore the fundamental principles, key steps involved, industry-specific considerations, and the limitations associated with this approach.

4 out of 5

| Language | : | English |

| File size | : | 1716 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Word Wise | : | Enabled |

| Print length | : | 144 pages |

| Lending | : | Enabled |

| Item Weight | : | 11.24 pounds |

| Dimensions | : | 5.83 x 8.27 inches |

| Hardcover | : | 302 pages |

Principles of the Market Approach

The market approach assumes that the value of a business is directly related to the prices paid for similar businesses in recent transactions. This approach relies on the principle of substitution, which suggests that a buyer will not pay more for a business than it would cost to acquire a comparable business.

The key premise of the market approach is that similar businesses with similar financial performance and growth potential should trade at similar multiples of earnings, revenue, or other relevant financial metrics.

Steps Involved in the Market Approach

The Market Approach to Valuing Businesses Workbook outlines the following steps involved in conducting a market analysis:

- Identify Comparable Companies: Determine a group of publicly traded or recently acquired businesses that are comparable to the subject business in terms of industry, size, financial performance, and other relevant characteristics.

- Collect Financial Data: Gather financial information for the comparable companies, including financial statements, market data, and industry reports.

- Calculate Market Multiples: Determine the valuation multiples (e.g., price-to-earnings ratio, price-to-sales ratio) for each comparable company by dividing their market capitalization or acquisition price by their respective financial metrics.

- Adjust for Differences: Adjust the market multiples to reflect any material differences between the subject business and the comparable companies. This may involve considerations such as size, growth potential, and industry outlook.

- Apply Market Multiples: Apply the adjusted market multiples to the subject business's financial metrics to estimate its value.

Industry-Specific Considerations

The Market Approach to Valuing Businesses Workbook emphasizes the importance of industry-specific considerations when applying the market approach.

- Technology Industry: In rapidly evolving industries like technology, the market approach may require adjustments for factors such as intellectual property, research and development expenses, and customer acquisition costs.

- Healthcare Industry: The healthcare industry is heavily regulated, and valuations may be influenced by factors such as government reimbursement policies, patent protection, and the competitive landscape.

- Retail Industry: The retail industry is highly sensitive to consumer trends, and valuations may be affected by factors such as e-commerce penetration, store footprint, and brand recognition.

Limitations of the Market Approach

While the market approach is a widely-accepted valuation methodology, it has certain limitations:

- Data Availability: The accuracy of the market approach depends on the availability of reliable and comparable financial data for peer companies.

- Market Volatility: Market conditions can be volatile, which may impact the valuation multiples used in the analysis.

- Subjectivity: The selection of comparable companies and the application of adjustments can introduce some level of subjectivity into the valuation process.

The Market Approach to Valuing Businesses Workbook provides a comprehensive framework for understanding and applying the market approach to business valuation. By following the principles outlined in this guide and considering industry-specific factors, businesses can gain valuable insights into their market value and make informed decisions regarding financial planning and strategic growth.

It is important to note that business valuation is a complex process, and the market approach should not be used in isolation. A combination of valuation methodologies, along with qualitative factors, should be considered to provide a comprehensive and accurate assessment of a business's value.

4 out of 5

| Language | : | English |

| File size | : | 1716 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Word Wise | : | Enabled |

| Print length | : | 144 pages |

| Lending | : | Enabled |

| Item Weight | : | 11.24 pounds |

| Dimensions | : | 5.83 x 8.27 inches |

| Hardcover | : | 302 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Page

Page Text

Text Story

Story Paperback

Paperback Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Glossary

Glossary Preface

Preface Synopsis

Synopsis Manuscript

Manuscript Scroll

Scroll Codex

Codex Classics

Classics Narrative

Narrative Biography

Biography Reference

Reference Dictionary

Dictionary Narrator

Narrator Character

Character Resolution

Resolution Librarian

Librarian Catalog

Catalog Card Catalog

Card Catalog Stacks

Stacks Archives

Archives Periodicals

Periodicals Study

Study Scholarly

Scholarly Rare Books

Rare Books Special Collections

Special Collections Interlibrary

Interlibrary Thesis

Thesis Dissertation

Dissertation Reading List

Reading List Book Club

Book Club Theory

Theory Robin Blackburn

Robin Blackburn Eleanor Roosevelt

Eleanor Roosevelt Carl Gustav Jung

Carl Gustav Jung Tania Stephanson

Tania Stephanson Mary Downing Hahn

Mary Downing Hahn Lee Mun Wah

Lee Mun Wah Billy Collins

Billy Collins Patry Francis

Patry Francis James Gow

James Gow Yves Engler

Yves Engler Forrest Stuart

Forrest Stuart Greg Margolis

Greg Margolis Christopher M Loftus

Christopher M Loftus Iona Grey

Iona Grey Larissa Reinhart

Larissa Reinhart Trudy Joy

Trudy Joy Paddy Dillon

Paddy Dillon Davi Barker

Davi Barker Arne L Kalleberg

Arne L Kalleberg James Weldon Johnson

James Weldon Johnson

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Richard SimmonsScrambles In Snowdonia: 80 Of The Best Routes Snowdon Glyders Carneddau...

Richard SimmonsScrambles In Snowdonia: 80 Of The Best Routes Snowdon Glyders Carneddau... Bobby HowardFollow ·10.6k

Bobby HowardFollow ·10.6k Spencer PowellFollow ·5.4k

Spencer PowellFollow ·5.4k Elmer PowellFollow ·18.9k

Elmer PowellFollow ·18.9k William ShakespeareFollow ·4k

William ShakespeareFollow ·4k Dave SimmonsFollow ·7.8k

Dave SimmonsFollow ·7.8k Alvin BellFollow ·11.6k

Alvin BellFollow ·11.6k Vince HayesFollow ·13.3k

Vince HayesFollow ·13.3k Jorge Luis BorgesFollow ·9.1k

Jorge Luis BorgesFollow ·9.1k

F. Scott Fitzgerald

F. Scott FitzgeraldRobot Buddies: Search For Snowbot

In the realm of...

Mario Vargas Llosa

Mario Vargas LlosaUnlocking Academic Success: A Comprehensive Guide to...

In the ever-challenging academic...

Gabriel Blair

Gabriel BlairMake $000 Per Month Selling Your YouTube Freelancing...

Are you looking for a...

4 out of 5

| Language | : | English |

| File size | : | 1716 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Word Wise | : | Enabled |

| Print length | : | 144 pages |

| Lending | : | Enabled |

| Item Weight | : | 11.24 pounds |

| Dimensions | : | 5.83 x 8.27 inches |

| Hardcover | : | 302 pages |