A Comprehensive Guide to Local Tax Policy: Understanding the Fundamentals

4.8 out of 5

| Language | : | English |

| File size | : | 835 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 163 pages |

| Item Weight | : | 1.18 pounds |

| Dimensions | : | 5.35 x 1.38 x 8.39 inches |

Local tax policy plays a crucial role in shaping the economic and social landscape of communities. It involves the decisions made by local governments to raise revenue and allocate resources. Understanding the fundamentals of local tax policy is essential for informed decision-making and effective community engagement.

Key Elements of Local Tax Policy

Local tax policy encompasses a range of key elements, including:

- Tax Rates: The percentage or amount of tax levied on a particular tax base (e.g., property value, sales amount, income earned).

- Tax Bases: The assets, transactions, or activities that are subject to taxation (e.g., property, sales of goods and services, personal income).

- Tax Exemptions: Certain individuals, entities, or activities that are exempt from paying taxes (e.g., non-profit organizations, low-income individuals).

- Tax Incentives: Reductions or exemptions from taxes designed to encourage certain behaviors or investments (e.g., tax breaks for businesses that create jobs).

Types of Local Taxes

Local governments impose a variety of taxes depending on their specific needs and revenue goals. Common types of local taxes include:

Property Taxes

Property taxes are levied on the value of real estate, such as homes, commercial buildings, and land. They are a major source of revenue for local governments, particularly for funding public education.

Sales Taxes

Sales taxes are imposed on the sale of goods and services within a jurisdiction. They are a relatively easy-to-collect tax that generates significant revenue for local governments.

Income Taxes

Income taxes are levied on personal and business income earned within a jurisdiction. They are a progressive tax, meaning that higher earners pay a larger share of the tax burden.

Implementation and Administration of Local Tax Policy

The implementation and administration of local tax policy are complex processes. They involve several key steps:

- Tax Code Development: Local governments develop tax ordinances that establish the legal framework for tax collection.

- Taxpayer Registration: Businesses and individuals must register with the local tax authority to obtain a tax identification number.

- Tax Assessment: Tax authorities assess the value of property and businesses to determine their tax liability.

- Tax Collection: Taxes are collected through a variety of methods, such as direct billing, withholding from wages, and tax liens.

- Tax Audits: Tax authorities conduct audits to ensure compliance with tax laws and regulations.

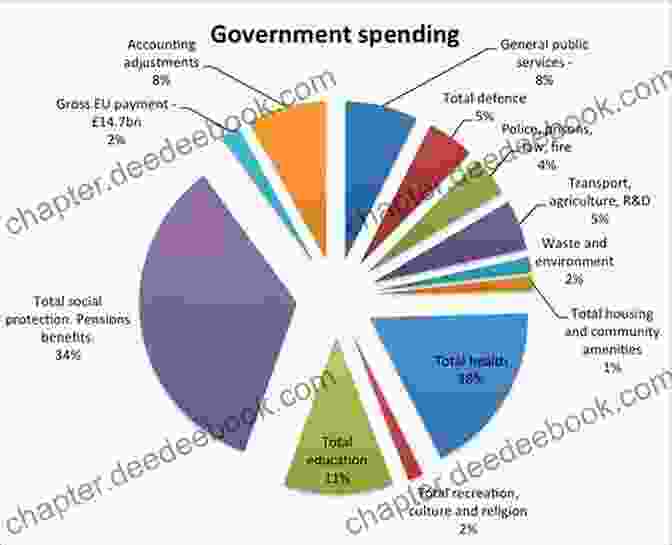

Impact of Local Tax Policy on Communities

Local tax policy has a significant impact on communities. It affects:

Revenue Generation

Local taxes are a primary source of revenue for local governments. The revenue generated funds essential public services, such as education, healthcare, public safety, and infrastructure.

Economic Development

Tax incentives can be used to attract businesses and stimulate economic activity in a community. However, high tax rates can discourage investment and slow economic growth.

Property Values

Property taxes can affect property values. High property taxes can lead to lower property values, while property tax exemptions can make homeownership more affordable.

Equity and Fairness

Tax policies should aim to distribute the tax burden fairly among all taxpayers. Progressive taxes tend to shift the burden onto higher earners, while regressive taxes disproportionately affect lower-income households.

Local tax policy is a complex and multifaceted issue that has a profound impact on communities. Understanding the fundamentals of local tax policy is essential for informed decision-making, effective community engagement, and equitable and sustainable local government finance.

4.8 out of 5

| Language | : | English |

| File size | : | 835 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 163 pages |

| Item Weight | : | 1.18 pounds |

| Dimensions | : | 5.35 x 1.38 x 8.39 inches |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Genre

Genre Library

Library Paperback

Paperback E-book

E-book Paragraph

Paragraph Bookmark

Bookmark Shelf

Shelf Bibliography

Bibliography Foreword

Foreword Preface

Preface Annotation

Annotation Manuscript

Manuscript Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Dictionary

Dictionary Thesaurus

Thesaurus Character

Character Resolution

Resolution Librarian

Librarian Borrowing

Borrowing Stacks

Stacks Scholarly

Scholarly Lending

Lending Academic

Academic Journals

Journals Rare Books

Rare Books Literacy

Literacy Study Group

Study Group Thesis

Thesis Awards

Awards Theory

Theory Ford Risley

Ford Risley Thomas Winterbottom

Thomas Winterbottom Carolee Laine

Carolee Laine Jan Baynham

Jan Baynham Landis Wade

Landis Wade Ursula Markham

Ursula Markham Susan Normington

Susan Normington Rolo Graziano

Rolo Graziano Pamela Uschuk

Pamela Uschuk Michael Croland

Michael Croland Lou Ross

Lou Ross Leif Wenar

Leif Wenar Ivo H Daalder

Ivo H Daalder Mike Smith

Mike Smith Sybil Sharpe

Sybil Sharpe Francis Duncan

Francis Duncan Murray Leinster

Murray Leinster David Drake

David Drake Karsinova

Karsinova Ruth Gorgosch

Ruth Gorgosch

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Harrison BlairFollow ·4.7k

Harrison BlairFollow ·4.7k Duane KellyFollow ·10.9k

Duane KellyFollow ·10.9k Mike HayesFollow ·3.7k

Mike HayesFollow ·3.7k Joshua ReedFollow ·13.7k

Joshua ReedFollow ·13.7k Tom ClancyFollow ·6.3k

Tom ClancyFollow ·6.3k Daniel KnightFollow ·4.9k

Daniel KnightFollow ·4.9k Winston HayesFollow ·10.8k

Winston HayesFollow ·10.8k Evan SimmonsFollow ·17.5k

Evan SimmonsFollow ·17.5k

F. Scott Fitzgerald

F. Scott FitzgeraldRobot Buddies: Search For Snowbot

In the realm of...

Mario Vargas Llosa

Mario Vargas LlosaUnlocking Academic Success: A Comprehensive Guide to...

In the ever-challenging academic...

Gabriel Blair

Gabriel BlairMake $000 Per Month Selling Your YouTube Freelancing...

Are you looking for a...

4.8 out of 5

| Language | : | English |

| File size | : | 835 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 163 pages |

| Item Weight | : | 1.18 pounds |

| Dimensions | : | 5.35 x 1.38 x 8.39 inches |